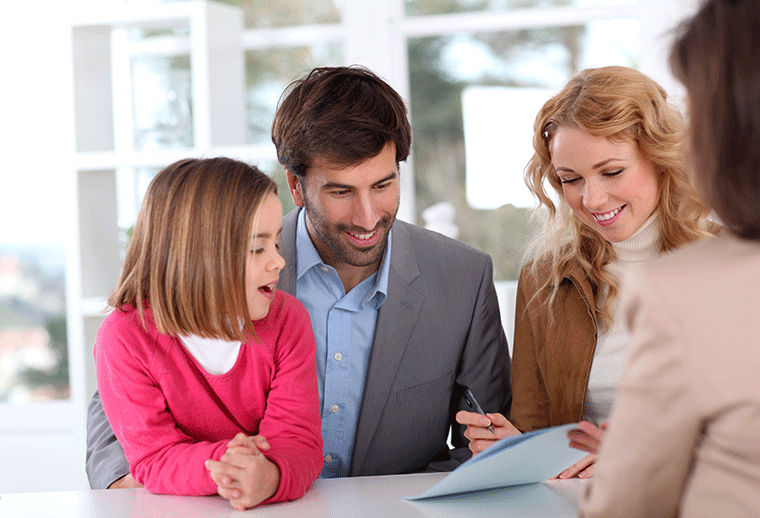

Many mortgage lenders require that you carry homeowner’s insurance. This protects their investment in the property. With this in place, you may feel adequately covered. There is one further step that you need to take. You need to understand what level of risk your home has for flooding. Flood damage is something that home insurance policies don’t cover. Our agents at Versatile Insurance Planners work with homeowners like you in San Antonio. We can help you decide if flood insurance is right for you.

The National Flood Insurance Program was created by Congress to protect homeowners and renters from losses. Legislators recognized that floods are the most common and expensive disasters facing homeowners. Financially, floods can cause a financial disaster. On average, a 1,00 sq. ft. house that sustains 1 ft. of water will result in $27,150 in damages. Also, 20% of claims for flood damage come from low to moderate risk areas. This is why it is so important to look at the risk data for the location of your home and thoughtfully consider additional flood coverage.

At Versatile Insurance Planners, our agents understand the flood risks in the San Antonio, TX area. They help home and businesses assess their level of risk and whether flood insurance is needed. They can answer any questions that you have and provide options for you. As flood insurance only covers buildings on a property, they can also ensure that your home insurance adequately covers your possession inside of the home. To get started, browse through the information on our website. When you are ready, contact us! You’ll be presented with the information you need, get questions answered, and be able to make your own decision about flood insurance. It’s good to have a knowledgeable partner to help with the process. Don’t wait until its too late! Contact us today!

Click to Call

Click to Call Get Directions

Get Directions